EURUSD

Fundamental Perspective

The EURUSD pair recovered from a three-week losing streak, approaching 1.0600 before meeting resistance, as the US Dollar retreated from its 2024 highs. After bottoming at 1.0332 on 22 November, the pair rebounded amid shifting sentiment driven by political and economic developments.

President-elect Donald Trump's nomination of Scott Bessent as Treasury Secretary hinted at a balanced economic strategy, as Bessent supported a gradual approach to tariffs. However, concerns resurfaced mid-week when Trump proposed imposing steep tariffs of 25% on Mexican and Canadian goods and up to 60% on Chinese imports, raising fears of inflationary pressures just as the Federal Reserve pivots toward easing monetary policy. Meanwhile, a temporary 60-day cease-fire between Israel and Hezbollah offered limited relief in geopolitical tensions.

In Europe, ECB board member Isabel Schnabel's hawkish tone offered short-term support for the Euro, as she emphasized a cautious rate-cutting approach amidst growth concerns linked to potential US trade actions. Inflation data showed modest easing, with Germany and the Eurozone reporting annual HICP increases below expectations. However, EU consumer confidence weakened further, highlighting lingering economic uncertainties.

The upcoming week will focus on critical US labor market data and PMI figures from both economies, which could shape the currency pair's trajectory amid ongoing geopolitical and inflationary pressures.

Technical Perspective

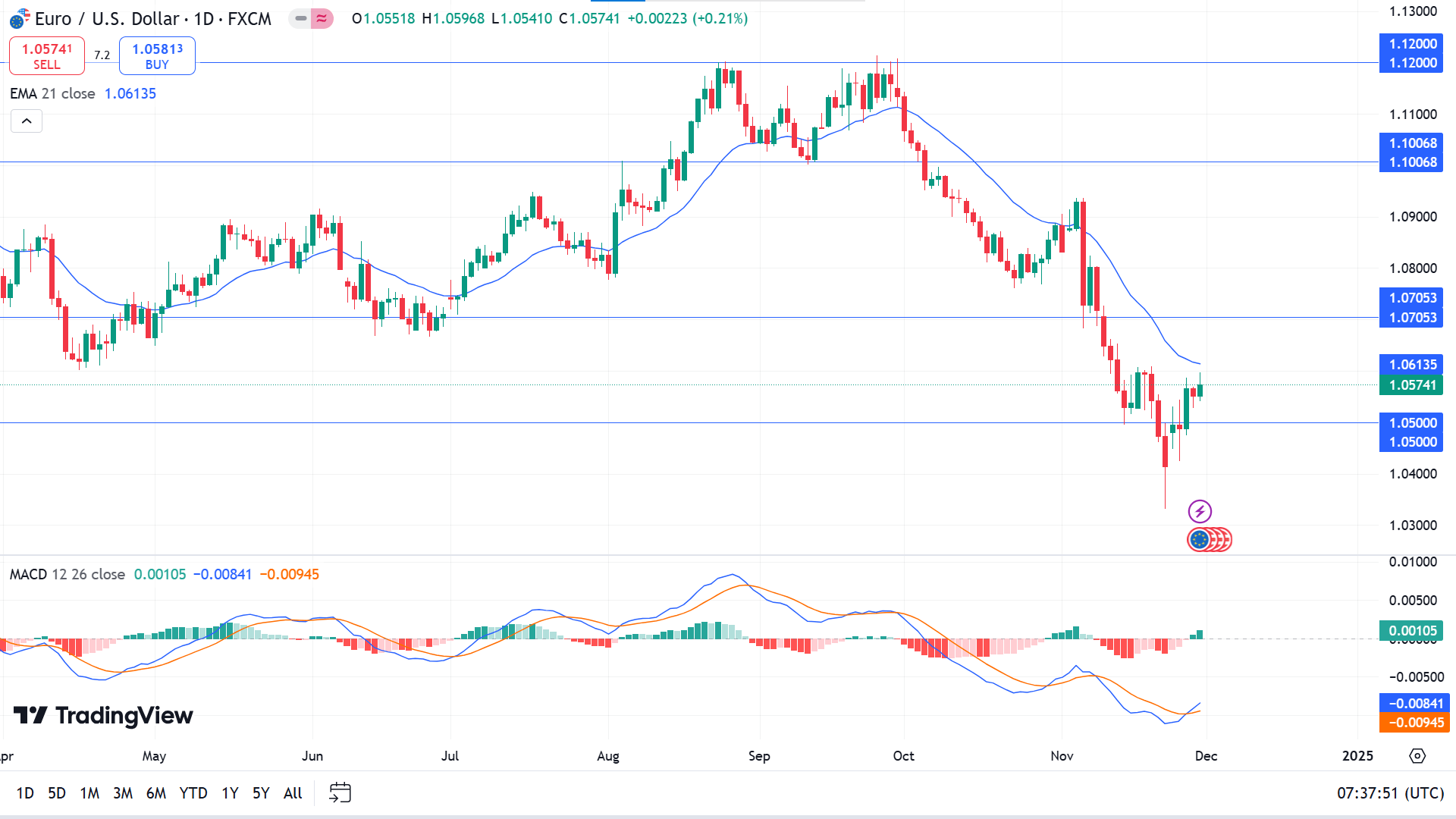

The EURUSD weekly chart shows a pause in the current downtrend after three consecutive losing candles; the last candle ended green, reflecting buyers' domination for the week.

On the daily chart, the price pullbacks above the 1.05 mark after reaching the yearly low of 1.0331. The price is still in a downtrend as it floats below the EMA 21 line, whereas the MACD indicator window indicating fresh bullish pressure reflects mixed signals for investors.

Evaluating the current market context, the price returned above the 1.0500 level, easing bearish pressure. If the price remains above the 1.0500 level, short-term buyers may be optimistic toward the nearest resistance, 1.0705.

Meanwhile, the bullish signal would be invalid if the price declines below the 1.0500 level and keeps floating there; it can continue to the low of 1.0331 or further downside.