EURUSD

Fundamental Perspective

The EURUSD pair closed the week lower as the US Dollar gained strength in a risk-averse market, though the currency pair remained within a tight range. Investor caution supported the Greenback, while profit-taking in the final hours relieved the Euro. The pair finished below the 1.0500 mark as traders prepared for the last central bank meetings of the year.

The European Central Bank (ECB) lowered its primary interest rates by 25 basis points each, in line with expectations, reducing the deposit facility, primary refinancing, and marginal lending rates to 3.00%, 3.15%, and 3.40%, respectively. Although the ECB revised its growth projections for the coming years, President Christine Lagarde’s less hawkish rhetoric suggested the bank is approaching a neutral stance. While risks to inflation are now seen as balanced, the ECB emphasized that decisions will remain data-dependent.

In the US, inflation data showed slight increases, with the November Consumer Price Index rising by 2.7% year-on-year and the Producer Price Index increasing by 3%. These figures aligned with expectations but did little to alter market expectations for a 25 basis point Fed rate cut next week.

Looking ahead, the economic calendar is busy with key data releases, including US Retail Sales, EU inflation, and the final Q3 GDP estimate, while central bank meetings will dominate market attention.

Technical Perspective

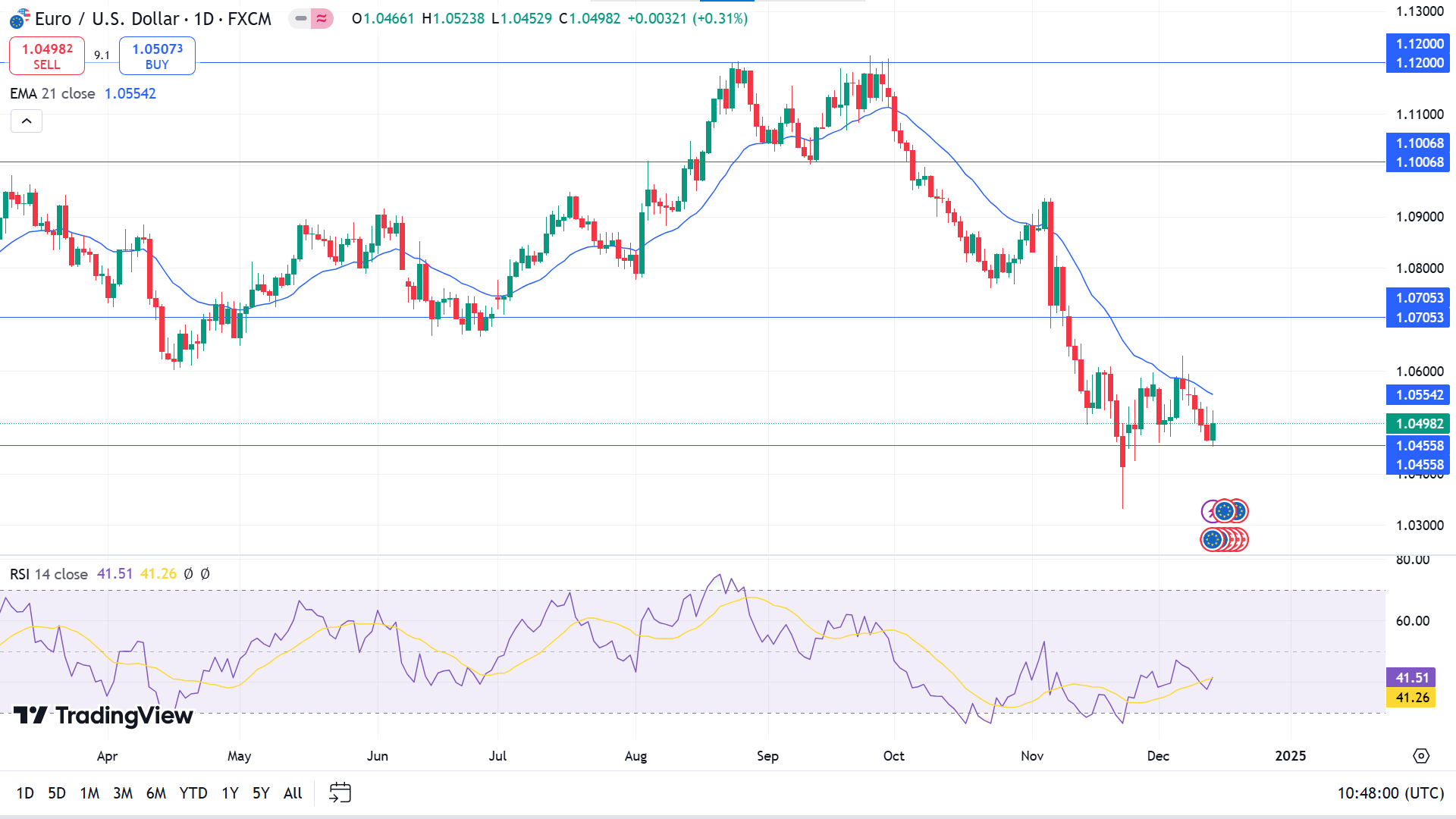

EURUSD finished with a red candle on the weekly chart, holding the support. The red candle comes after a doji, indicating the bearish trend is intact, leaving sellers optimistic.

The price moved below the EMA 21 declaring a bearish trend, supported by the Relative Strength Index (RSI) below the neutral line. However, the RSI line edged upward, declaring recent support can sustain and bulls can take control.

Based on this structure, the broader market context suggests sellers looking at the primary barrier near 1.0455 as breaking that level might trigger the price toward a further downside of 1.0345.

Meanwhile, the sell signal might lose validity after overcoming the 1.0455 level. If the support sustains, the pair might hit the primary resistance near 1.0705.