- Super Micro Computer's Q2 2024 saw a 143% revenue increase with an EPS of $6.25.

- Operating margin fell due to rising costs and Q2 inventory increased indicating growth preparation.

- SMCI forecasts substantial revenue growth for FY25, between $26B to $30B based on solid AI servers demand.

- SMCI Stock price dropped sharply despite strong revenue growth and technical analysis showing mixed signals with price targets ranging from $305 to $880.

I. Super Micro Computer Q2 2024 Performance Analysis

A. Key Segments Performance

Financial Highlights

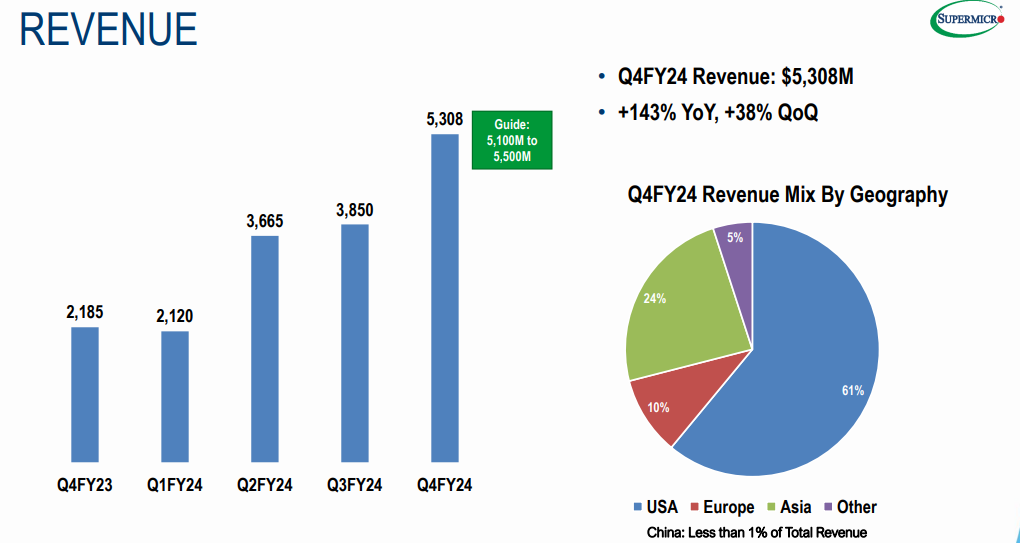

Super Micro Computer's (NASDAQ:SMCI) performance in Q2 2024 has demonstrated remarkable growth, reflecting a robust expansion in revenue and net income. For the period ending June 30, 2024, the company reported a substantial revenue of $5.31 billion, marking a 143% year-over-year increase. This impressive growth was fueled by strong demand for its AI infrastructure solutions, notably in Generative AI training and inferencing. The net income for Q2 reached $336 million, which translates to earnings per share (EPS) of $6.25, up 78% from the previous year.

Source: Q4 2024 Presentation

The operating margin for Q2 was 7.8%, slightly below expectations due to increased costs associated with DLC liquid cooling components and a higher proportion of hyperscale datacenter business. Despite this, the gross margin stood at 11.3%, reflecting a decline from the previous quarter's 15.6% due to product and customer mix and initial high costs in scaling new AI GPU clusters. Operating expenses saw a significant rise, reaching $253 million, up 75% year-over-year, driven by higher compensation and headcount.

The balance sheet shows a closing inventory of $4.4 billion, indicating preparations for future growth. Cash flow used in operations was $635 million, with a negative free cash flow of $662 million for the quarter. Capital expenditures totaled $27 million for Q2, contributing to the increased investment in global facilities, including a new plant in Malaysia. The company's net cash position was negative $504 million, reflecting a shift from a positive cash position in the prior quarter.

Operational Performance

Super Micro's operational performance in Q2 2024 highlights significant advancements and challenges. The company experienced robust product sales, with the majority coming from server and storage systems, which constituted 95% of Q4 revenue. The OEM appliance and large datacenter segment surged by 192% year-over-year, representing 64% of Q4 revenue, underscoring strong demand from major customers.

Market share analysis reveals that the U.S. remained the largest revenue contributor, accounting for 61% of Q4 sales. Asia saw a remarkable 437% increase, while Europe and the Rest of the World also experienced significant growth. Super Micro's new product innovations include advanced DLC liquid cooling solutions, which are gaining traction in the datacenter market. These solutions offer improved performance, reduced operational costs, and environmental benefits compared to traditional air-cooled systems.

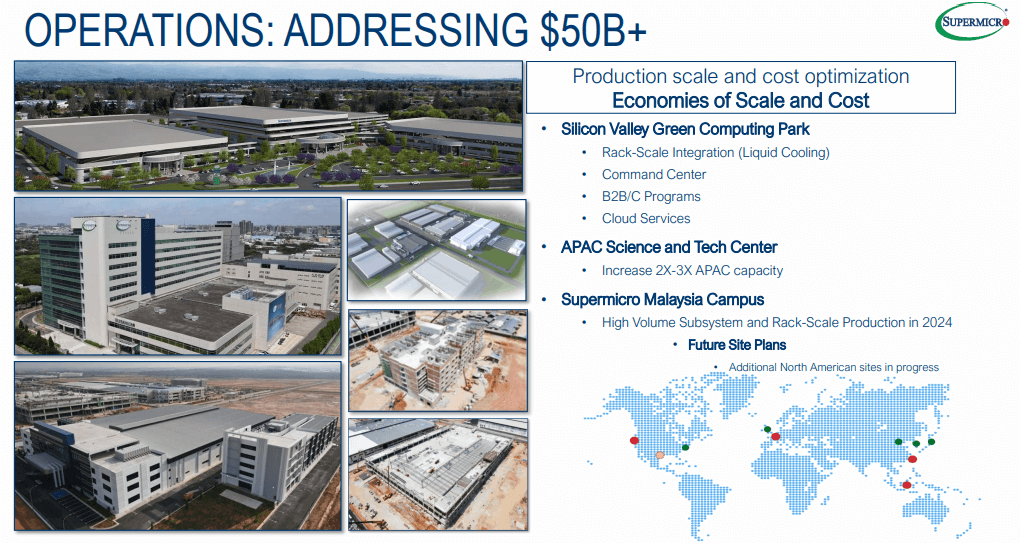

The company is focusing on scaling its production capabilities and addressing supply chain bottlenecks. Despite short-term constraints, Super Micro is positioned for future growth with an expanding portfolio of innovative products and strategic global expansions. The introduction of the Datacenter Building Block Solutions (DBBS) aims to expedite datacenter deployment and transformation, reflecting the company's commitment to enhancing efficiency and performance in the AI infrastructure space.

Source: Q4 2024 Presentation

B. SMCI Stock Price Performance

In Q2 2024, SMCI stock price fell significantly. Opening price was $1,010. Closing price dropped to $819.35. The stock reached a high of $1,069. It also fell to a low of $671. The percentage change in stock price was -18.9%. Compared to market indices, SMCI underperformed. The S&P 500 rose by 3.9%. NASDAQ showed a 7.7% gain. SMCI's decline contrasts sharply with positive returns in broader markets.

[Q2 2024 SMCI stock performance]

Source: tradingview.com

II. SMCI Stock Forecast: Outlook & Growth Opportunities

A. Segments with growth potential

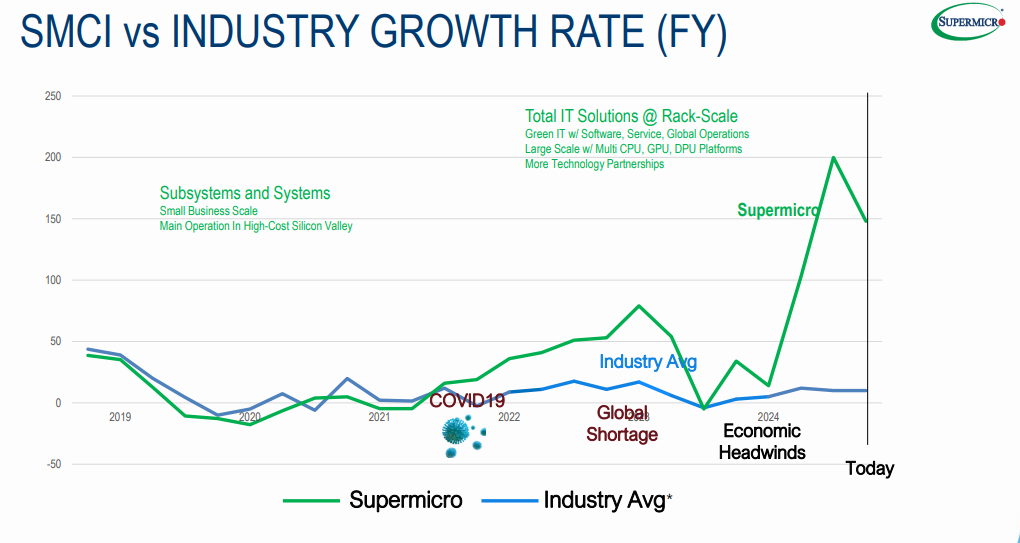

Super Micro Computer (SMCI) shows strong growth in the AI infrastructure market. The company's revenue guidance for Q1 FY25 is $6.0B to $7.0B. This represents a 183% to 230% YoY growth. For FY25, SMCI projects revenue of $26.0B to $30.0B, a 74% to 101% increase YoY. Key growth areas include Liquid Cooling Solutions and Data Center Building Block Systems (DCBBS). Liquid cooling is targeted for 25% to 30% of global new data center deployments within the next 12 months. The DCBBS architecture aims to enhance AI solutions' speed and efficiency.

SMCI's focus on generative AI training and inferencing drives robust growth. The company deploys some of the largest AI SuperClusters globally. Their DLC liquid cooling technology improves time-to-deployment (TTD) and time-to-online (TTO). This technology also lowers total cost of ownership (TCO) for AI solutions. The rapid adoption of SMCI's AI and liquid cooling technologies underpins its growth potential.

Despite short-term margin pressures, long-term investments provide competitive advantages. The company forecasts Q1 FY25 revenue between $6 billion to $7 billion. Fiscal 2025 revenue is projected between $26 billion to $30 billion. These forecasts reflect SMCI's strategic initiatives and market leadership.

Source: Q4 2024 Presentation

B. Expansions and strategic initiatives

SMCI is positioned as a leader in AI infrastructure solutions. They leverage system building blocks and rack-scale solutions. This approach helps customers achieve the best time-to-market with new technologies. SMCI's 4.0 DCBBS reduces new data center build time significantly. Smaller facilities or transformations can be completed in less than a year.

The new Malaysia campus will ramp up shipping volume and improve cost structure. Expansion in the US near Silicon Valley headquarters will boost DLC liquid cooling capacity. Global manufacturing expansion strengthens SMCI's market position. They enter fiscal 2025 with record-high backorders and strong product demand.