- Palantir's Q2 2024 saw a solid revenue increase and a strong operating margin, highlighting robust profitability.

- Significant contract wins and a 70% rise in U.S. commercial revenue underscore the company's expanding market share.

- Analysts project continued growth with EPS estimates with optimistic earnings outlooks and technicals also points to upside for Palantir's stock in 2024.

- Despite a positive forecast, high share-based compensation and competition from major players like Snowflake, Databricks, IBM, and Microsoft Azure poses risks.

I. Palantir Q2 2024 Performance Analysis

A. Key Segments Performance

Financial Highlights

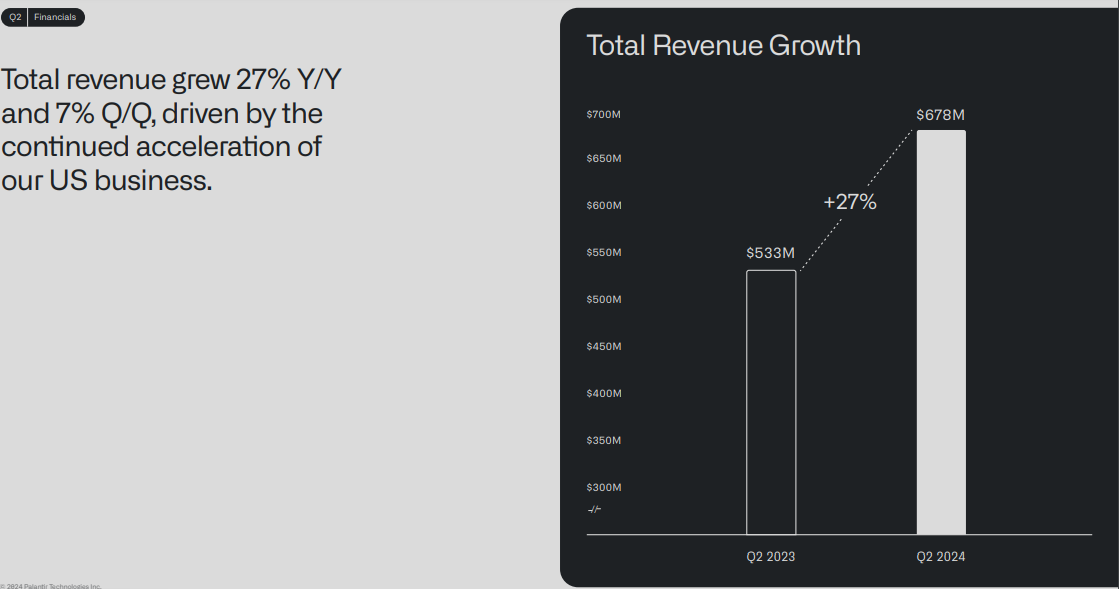

The company's revenue grew by 27% year-over-year last quarter. Net income reached $134 million, reflecting strong profitability. Earnings per share (EPS) stood at $0.09 on an adjusted basis. Profit margins remained healthy with an adjusted operating margin of 37%. Operating income also saw an increase, reaching $105 million. Total expenses grew by 7% year-over-year. The balance sheet remains robust with $4 billion in cash and cash equivalents. Cash flow from operations was $144 million, and free cash flow was $149 million, indicating strong liquidity.

Source: Q2 2024 Presentation

Operational Performance

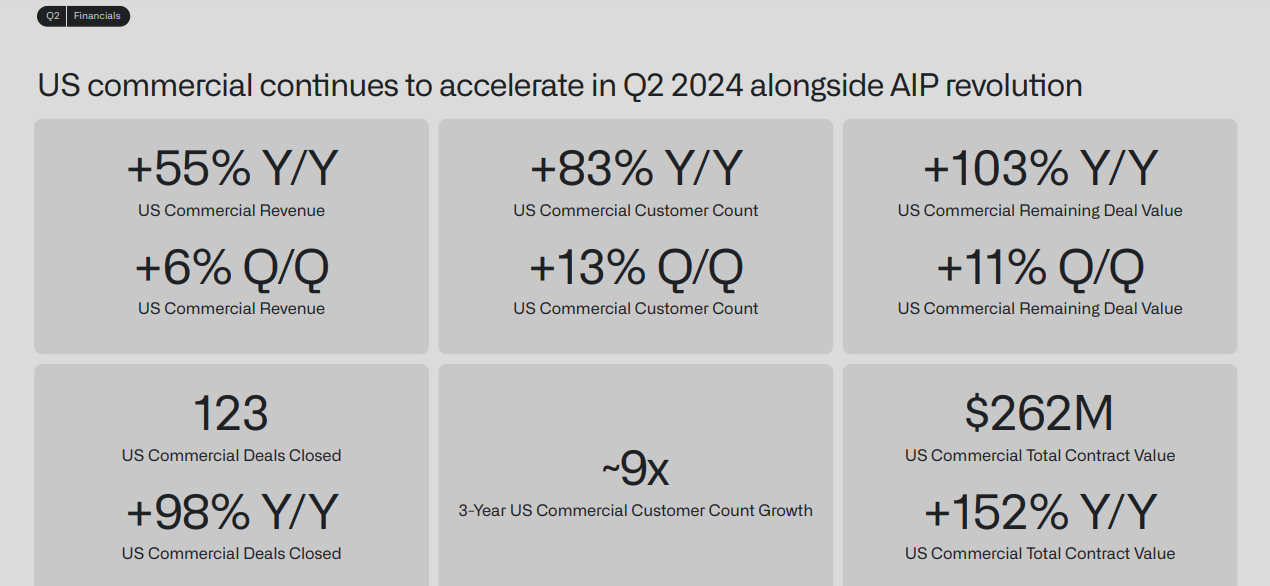

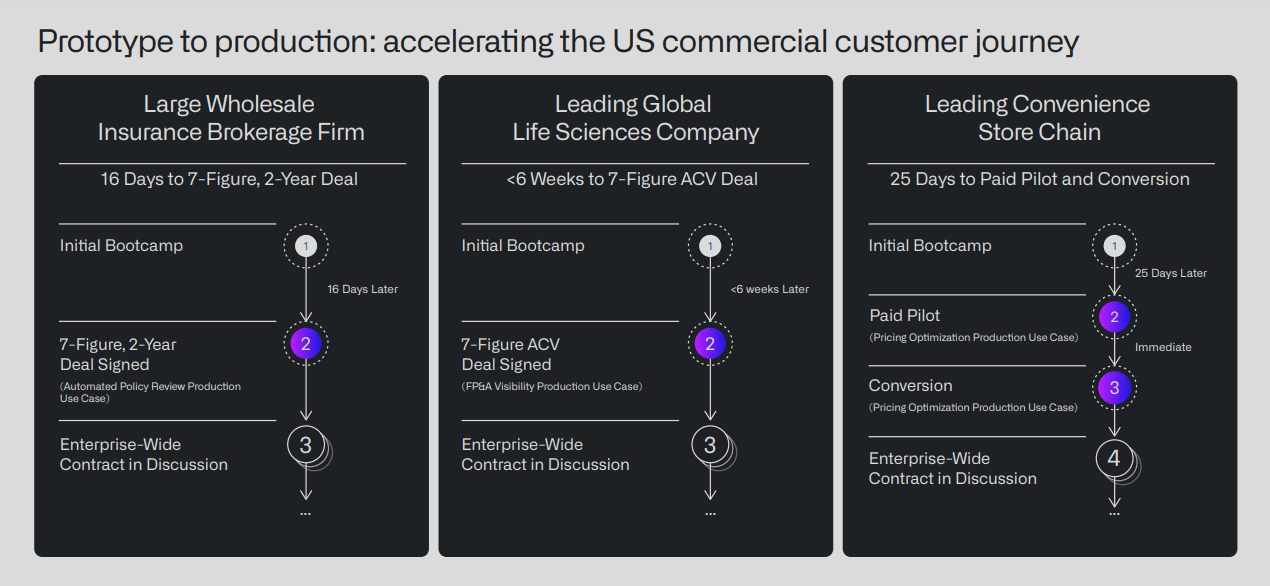

Operational metrics showed significant improvements. The company signed 27 deals worth $10 million or more. Total contract value (TCV) nearly reached $1 billion. Existing customers are expanding their contracts, driven by the company's AI platform, AIP. US commercial revenue, excluding strategic contracts, increased by 70% year-over-year. The US commercial annual contract value (ACV) grew by 44% year-over-year. The deal count in the US commercial sector nearly doubled compared to the previous year.

Product Sales Breakdown

Several notable product expansions were reported. Tampa General deployed AIP to reduce patient length of stay by 30%. Panasonic Energy expanded AIP across finance, quality control, and manufacturing. AARP utilized AIP for personalized experiences for 29 million visitors. Eaton deepened its relationship with AIP for ERP modernization and other use cases. Kinder Morgan expanded its AIP use for storage optimization and pipeline monitoring. These expansions highlight the versatility and demand for AIP across industries.

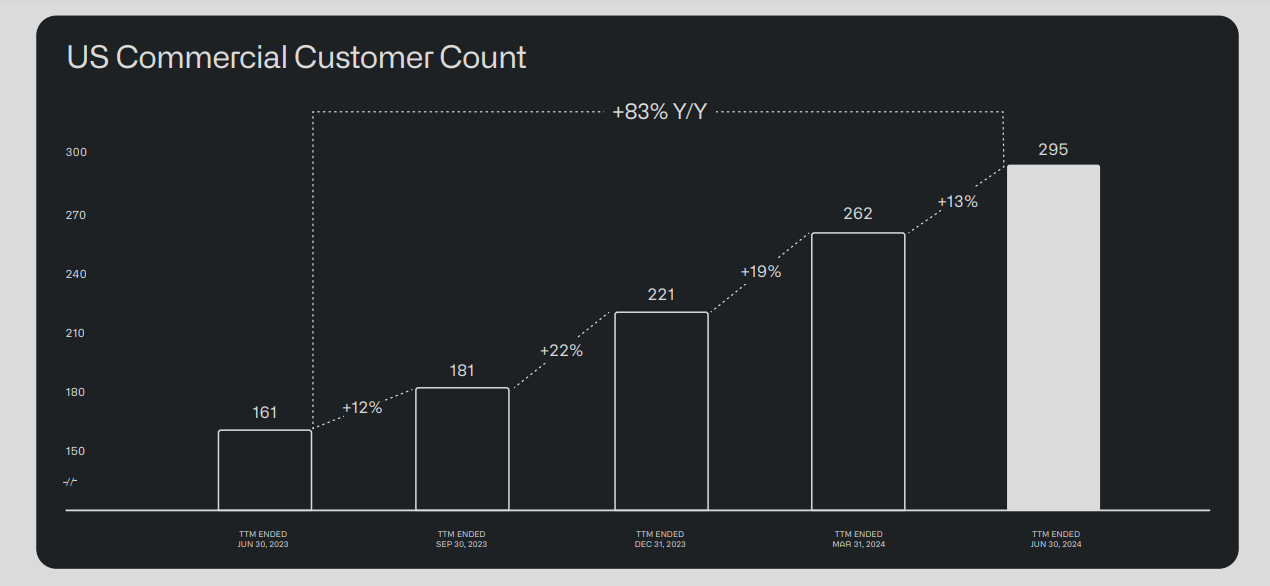

Market Share Analysis

The company's market share continues to grow. US commercial customer count increased by 83% year-over-year. The US government segment showed strong performance, with revenue growing by 24% year-over-year. International government revenue also saw an 18% sequential increase. These gains indicate a strengthening foothold in both domestic and international markets.

Source: Q2 2024 Presentation

New Product or Technological Advancements and Innovations

The company continues to innovate with new product launches. The AIP platform has been instrumental in these advancements. The company launched Warp Speed, a manufacturing operating system. This system leverages industrial AI and ontology for improved production processes. The platform aims to transform American manufacturing, echoing historical industrial mobilizations. Additionally, the company received a notable contract from the Department of Defense. This contract will scale AI-enabled systems across the DoD, demonstrating the critical importance of their software.

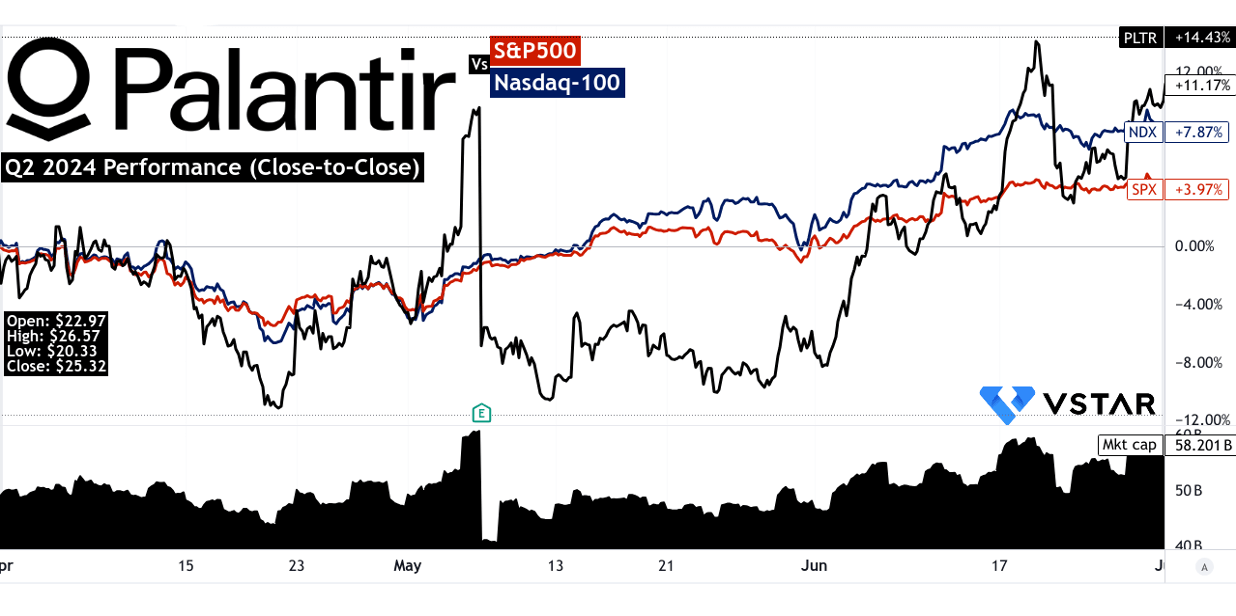

B. PLTR Stock Price Performance

Palantir Technologies' market cap stands at $58.201 billion as of Q2 2024. The stock opened at $22.97 and closed at $25.32. During the quarter, highs reached $26.57, and lows hit $20.33. During Q2, PLTR stock price saw an 11.17% increase. This performance outpaced major indices. The S&P 500 returned 3.97% in the same period. The NASDAQ returned 7.87%. Palantir's stock outperformed both indices significantly. This indicates strong Wall Street confidence.

Source: tradingview.com

II. PLTR Stock Forecast: Outlook & Growth Opportunities

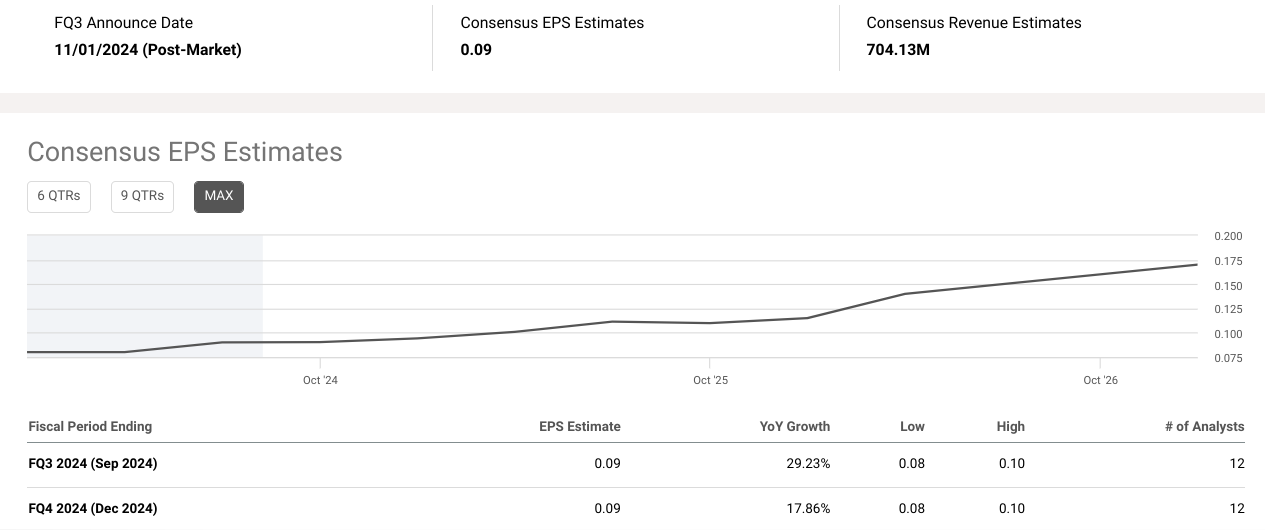

Palantir Technologies (PLTR) shows promising growth. Consensus EPS estimates for Q3 2024 are $0.09, with a 29.23% YoY increase. Analysts estimate EPS between $0.08 and $0.10. For Q4 2024, EPS is also expected at $0.09, reflecting 17.86% YoY growth. Revenue estimates for Q3 2024 are $704.13 million, a 26.15% increase YoY. Estimates range from $698.67 million to $724.10 million. Q4 2024 revenue is projected at $745.15 million, up 22.49% YoY.

Source: seekingalpha.com

Moreover, Palantir raises its full-year 2024 revenue guidance to $2.742 - $2.750 billion. US commercial revenue is expected to exceed $672 million, growing at least 47%. Adjusted income from operations is projected between $966 - $974 million. The company anticipates adjusted free cash flow of $800 million to $1 billion.

A. Segments with growth potential

Palantir's commercial segment has seen substantial growth. The U.S. commercial business reported a 70% year-over-year revenue increase (excluding strategic commercial contracts). This growth is largely driven by the adoption of the Artificial Intelligence Platform (AIP). Significant deals have been signed with existing customers like Tampa General and Panasonic Energy of North America. These customers expanded their engagements to leverage AIP in various operations.

Source: Q2 2024 Presentation

Additionally, Palantir's government segment continues to be robust. The company secured several notable contracts, including a $153 million initial order from the Department of Defense.

This contract supports AI-enabled operating systems across combatant commands and the joint staff. Palantir's software is critical to national defense, further cementing its role in the government sector.

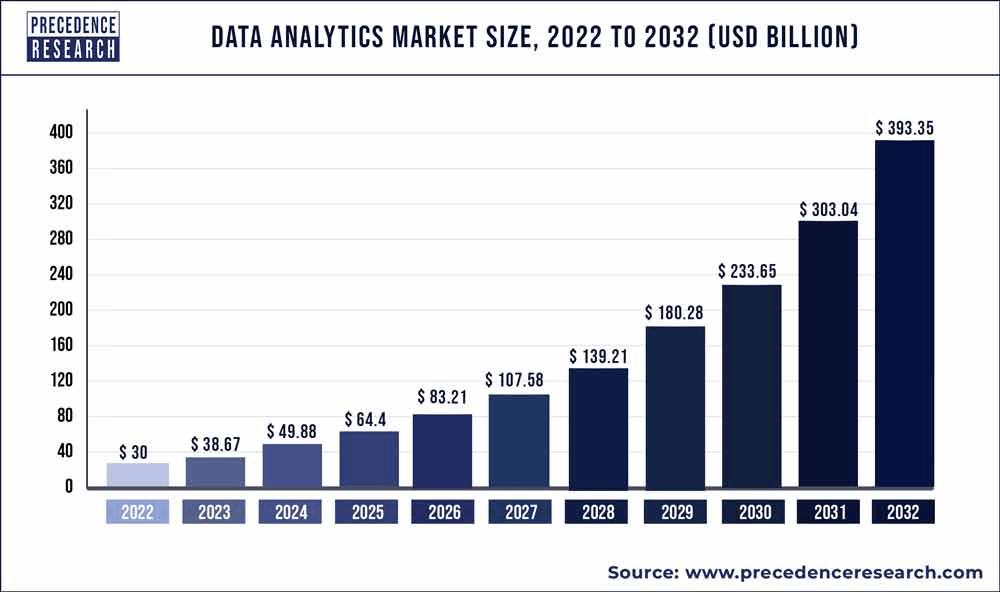

Source: precedenceresearch.com

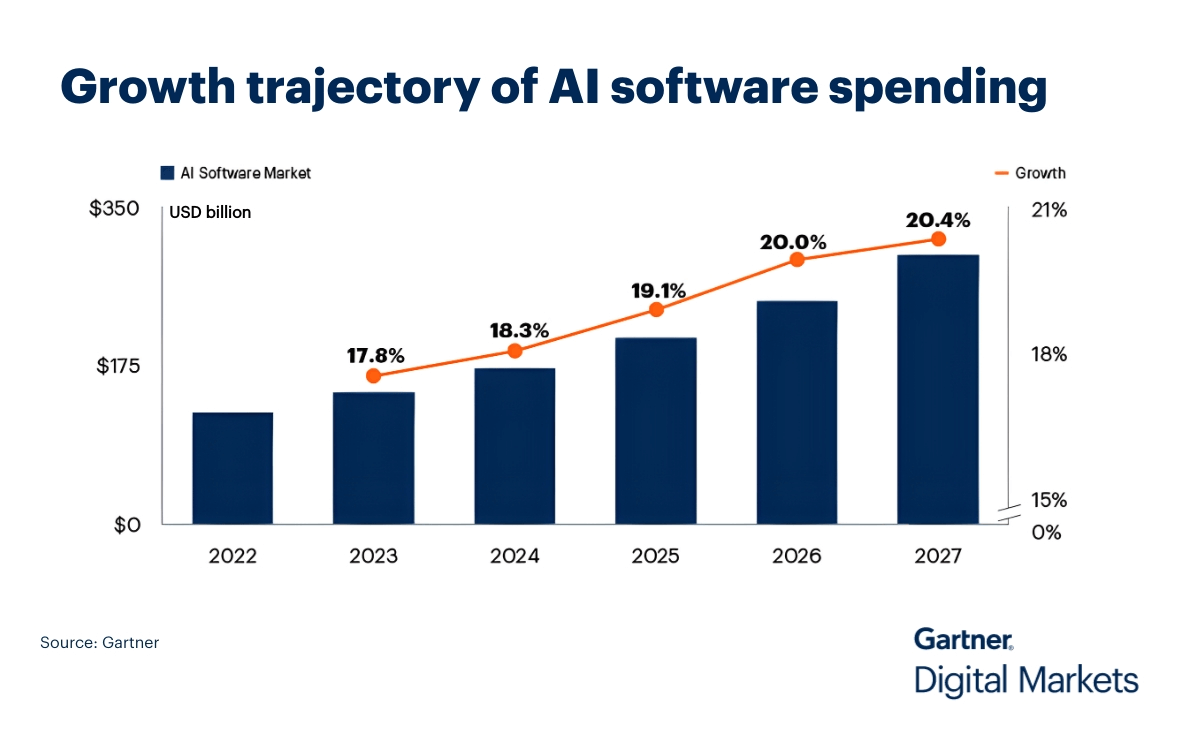

As per precedenceresearch.com, the global data analytics market revenue may hit $50 billion in 2024 and may reach $400 billion by 2032 at a projected CAGR of 29.4% (2023 to 2032). Similarly, As per Gartner the AI software market revenue will hit $300 billion by 2027 at an annual rate of 19.1%.

Source: Gartner.com

B. Expansions and strategic initiatives

Research and Development Investments

R&D is a cornerstone of Palantir's growth strategy. The company has made significant investments in developing AIP and Apollo, which streamline AI deployment and management. Palantir's R&D efforts also focus on ontology and compute modules, enabling sophisticated applications in both commercial and government sectors. These innovations help in integrating customers' containerized applications into operational workflows that boosts the company's client base and top-line.

Source: Q2 2024 Presentation

Partnerships and Collaborations

Palantir has forged massive and critical partnerships to derive growth. The company collaborates with entities like Eaton and Kinder Morgan to modernize ERP deployments and optimize storage and pipeline monitoring, respectively. These collaborations leverage Palantir's AI capabilities to deliver tangible business outcomes.

Furthermore, Palantir's work with the Department of Defense showcases its ability to handle complex, mission-critical projects. The Open DAGIR initiative, worth $33 million, allows defense tech companies and government developers to build applications on Palantir's platform. This initiative is pivotal in expanding Palantir's footprint in the defense sector.