I. Recent Dell Stock Performance

DELL Forecast from Conference Call

For the quarter ended August 2, Dell reported a 9.1% year-over-year revenue increase, reaching $25 billion, primarily driven by an 80% surge in servers and networking revenue to a record $7.7 billion. Meanwhile, EPS rose by 8.6% to $1.89.

According to Yahoo Finance, Wall Street's analysts predicted $24.5 billion in revenue and an EPS of $1.71, but the result exceeded expectations.

Dell projected full-year revenue on a conference call between $95.5 billion and $98.5 billion, with EPS expected at $7.80, plus or minus 25 cents. Meanwhile, analysts forecast slightly lower revenue of $96.3 billion and EPS of $7.70.

Dell estimates revenue between $24 billion and $25 billion for Q3, with EPS around $2, within a 10-cent margin. Analysts are slightly more optimistic, expecting $24.6 billion in revenue and $2.20 in EPS.

Wells Fargo Indicated A Strong Supply Chain in DELL

Wells Fargo highlights Dell's strong capital return strategy as a cornerstone of their investment thesis, emphasizing its dedication to shareholder returns through dividends and buybacks. This commitment, alongside Dell's focus on debt reduction, underpins Wells Fargo's Overweight rating.

The company also commends Dell's effective use of supply chain efficiencies, noting that its expansive product portfolio and seamless integration in software and hardware provide a unique edge. This positions Dell to benefit from the ongoing shift toward a hybrid, software-defined, multi-cloud data center environment.

Wells Fargo views Dell as presenting a compelling long-term risk/reward proposition driven by its strategic positioning and comprehensive offerings. They believe Dell is well-placed to capitalize on emerging technology trends, enhancing its appeal as a substantial investment opportunity.

Expert Insights on DELL Stock Forecast for 2024, 2025, 2030 and Beyond

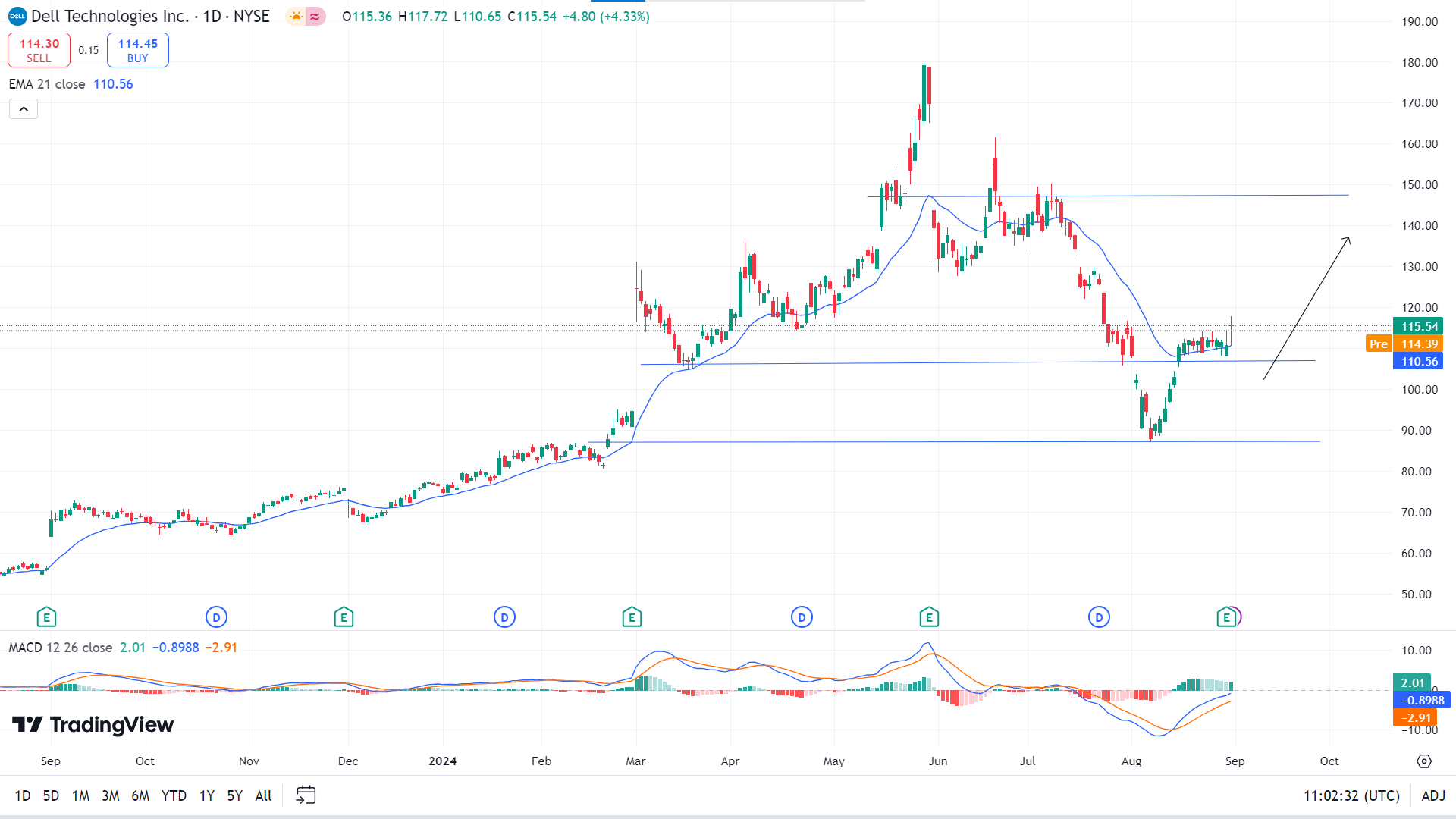

Dell stock price hit the ATH near 179.70 in May this year. Since then, the price has dropped, support is near 86.93, and it bounced back. So, the Q3 was bearish for the Dell stock price, and now, it may seek to meet the ATH or beyond. Before checking on details on the Dell stock forecast for 2024, 2025, 2030, and Beyond, let's see what analysts think about DELL stock:

|

Providers |

2024 |

2025 |

2030 & beyond |

|

Coinpriceforecast |

$117 |

$163 |

$363 |

|

usastocksforecast |

$140 |

$161.91 |

$468.42 |

|

Stockscan |

$136.16 |

$134.57 |

$174.37 |

|

Coincodex |

$135.37 |

$142.99 |

$411.97 |

II. DELL Stock Forecast 2024

The DELL stock bounced back from the August low of 86.93 and may reach the ATH of 179.70 by the end of 2024.

In the broader outlook, the price made a significant high and reached the significant level of 180.00 level. Since then, significant selling pressure has come, creating a counter-impulsive momentum.

In the near-term price action, the price consolidates above the EMA 21 line, breaking an acceptable previous resistance of 106, which now acts as a support level. In contrast, the MACD indicator window suggests bullish pressure through the signal lines edging upside and green histogram bars above the midline. The price might hit the nearest resistance of 147 due to this bullish pressure. Meanwhile, any breakout may trigger the price toward the next resistance near 179.70, the ATH.

Meanwhile, the price is still below the EMA 50 line, acting as a dynamic resistance, and the ADX indicator reading is still below 25, indicating the recent bullish pressure may lose power and the price may decline toward the primary support near 106.00 before making an upward movement, whereas the next support is near 87.00.