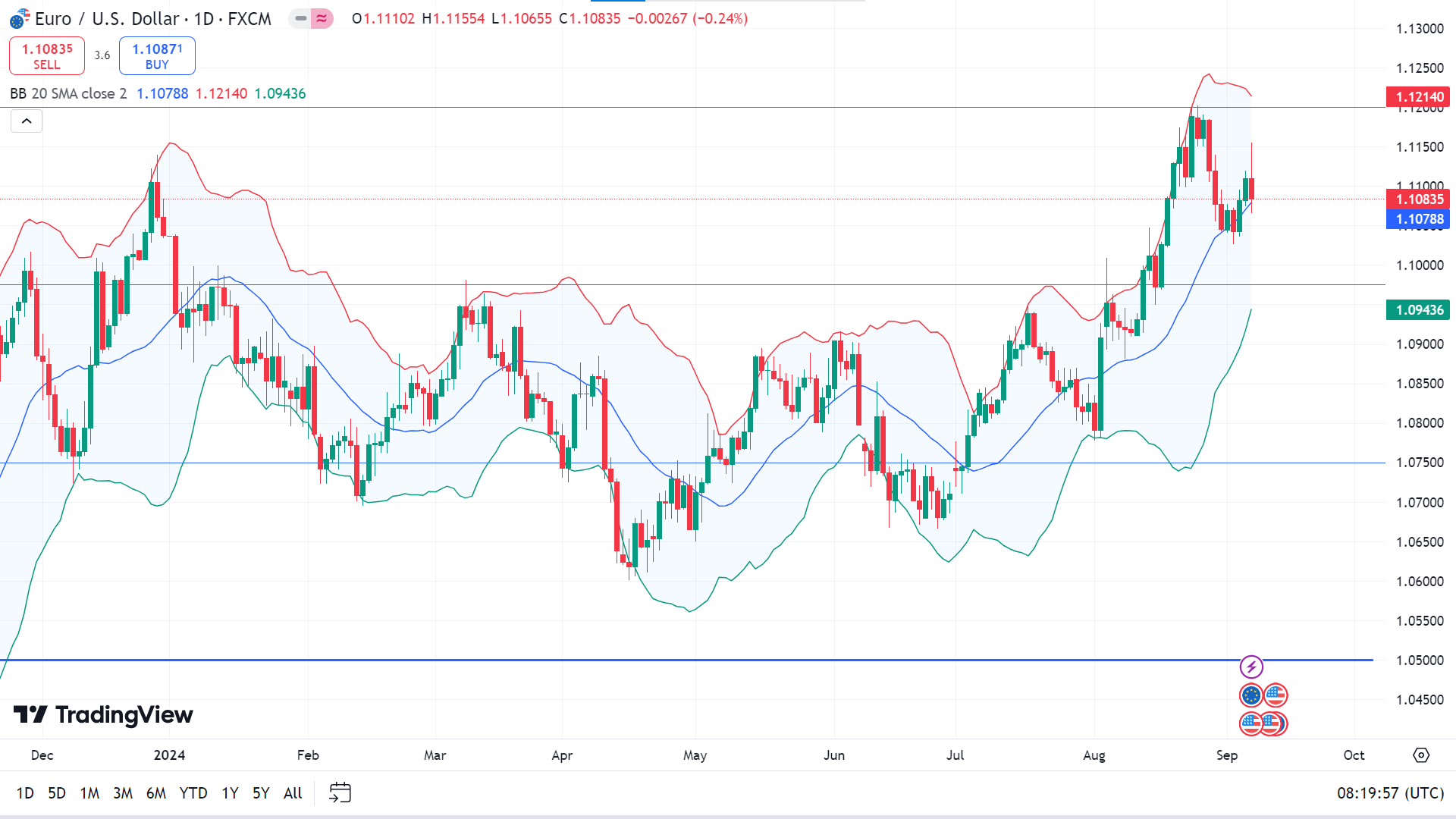

EURUSD

Fundamental Perspective

The EURUSD pair reversed after dropping to 1.1025, stabilizing mid-week and closing near 1.1100 after peaking at 1.1154 on Friday. Macroeconomic data from the Eurozone and the US influenced the pair's movement, with investors focusing on developments that might impact monetary policy.

In the Eurozone, weak economic performance kept the Euro subdued. The Manufacturing PMI was revised slightly higher to 45.8 in August but remained in contraction, while the Services PMI dropped to 52.9. July's Producer Price Index rose 0.8% month-over-month but declined 2.1% year-over-year, and Q2 GDP growth was revised down to 0.2%. With the European Central Bank likely to cut interest rates by 25 basis points on September 12, the market is looking for any forward guidance that could shift expectations.

In the US, disappointing employment figures fueled expectations of the Federal Reserve's potential 50-basis-point rate cut. ADP reported only 99,000 new jobs in August, while layoffs surged, and job openings fell to 7.67 million. The Nonfarm Payrolls report also missed forecasts, showing 142,000 new jobs. However, the Fed is still likely to opt for a more modest 25-basis-point rate cut at its upcoming meeting, with key inflation and sentiment data still to come.

Technical Perspective

On the weekly chart, the last candle closed with a small green body and an upper wick after a solid red candle, reflecting buyers' activity.

On the daily chart, the price is on the upper channel of the Bollinger bands indicator, reflecting the bullish pressure on the asset price. So, the price may head toward the nearest resistance near 1.1214, followed by the next resistance near 1.1432.

Meanwhile, if the price declines below the midline, it will open the room for the price to reach the nearest support near 1.0950, followed by the next support near 1.0745.