- TSMC's Q2 2024 revenue surged considerably, based on strong performance in advanced technologies.

- TSMC's 3nm and 5nm technologies are key growth drivers, while 2nm technology is set for production in 2025.

- Technical outlook is positive with TSM stock price rose outpacing major indices like S&P 500 and NASDAQ.

I. TSMC Q2 2024 Performance Analysis

A. Key Segments Performance

Financial Highlights:

TSMC reported consolidated revenue of NT$673.51 billion (US$20.82 billion) for Q2 2024, marking a 40.1% increase year-over-year and a 13.6% sequential growth. In USD terms, this represents a 32.8% year-over-year rise. Net income stood at NT$247.85 billion (US$7.68 billion), with diluted earnings per share (EPS) at NT$9.56 (US$1.48 per ADR unit), reflecting a 36.3% increase year-over-year. Gross margin was 53.2%, operating margin was 42.5%, and net profit margin was 36.8%, highlighting stable profitability despite rising costs.

Operational Performance:

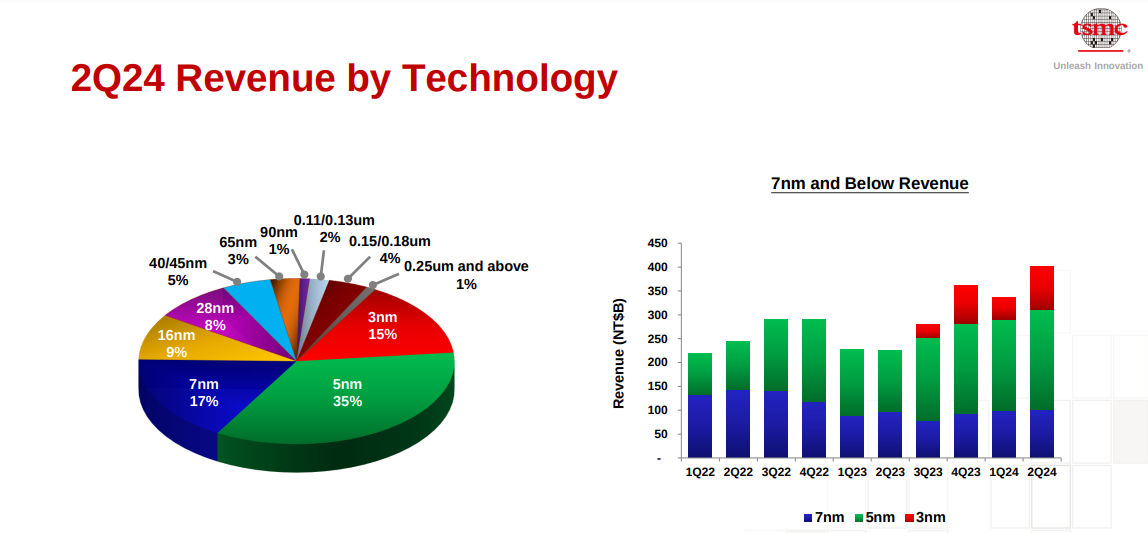

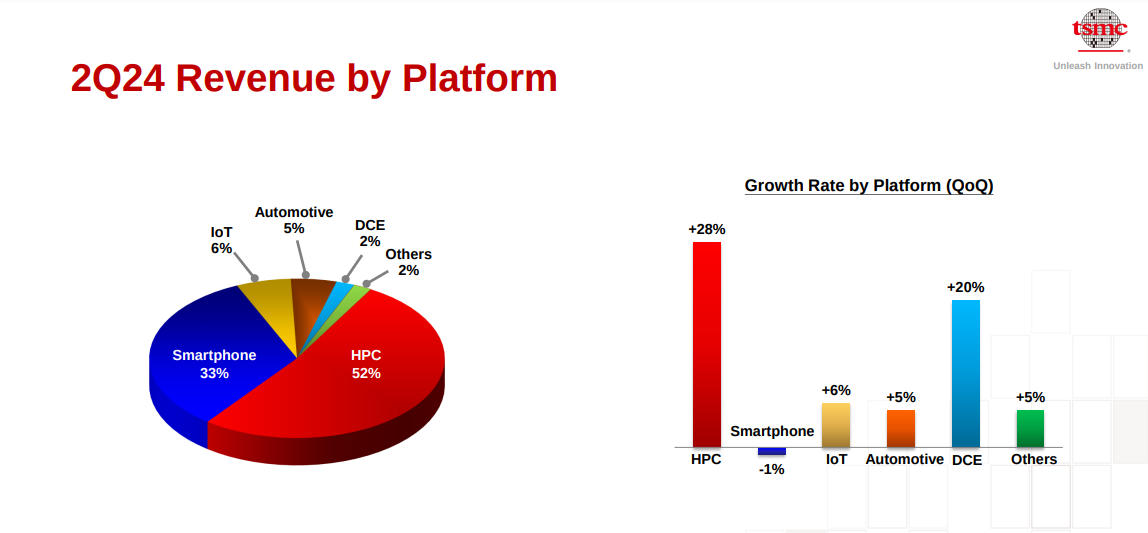

3-nanometer technology contributed 15% to total wafer revenue. Whereas, 5-nanometer technology represented 35%. Meanwhile, 7-nanometer technology accounted for 17%. To be specific, Advanced technologies (7nm and below) comprised 67% of wafer revenue. TSMC's High-Performance Computing (HPC) segment surged by 28% quarter-over-quarter, making up 52% of Q2 revenue. The smartphone segment declined by 1%, while IoT and automotive segments grew by 6% and 5%, respectively.

Source: Q2 2024 Presentation

TSMC ended the quarter with NT$2 trillion (US$63 billion) in cash and marketable securities. Its current liabilities rose by NT$23 billion, with long-term debt increasing by NT$9 billion. Accounts receivable turnover days decreased to 28 days, and inventory days fell to 83 days.

Technological Advancements and Innovations

TSMC's R&D focus remains strong, with continued advancements in 3nm and 5nm technologies. The company is also progressing with its 2nm technology, expected to enter volume production in 2025. The N2 technology is set to deliver significant performance and power benefits, with N2P and A16 further enhancing TSMC's technology portfolio. These technologies are poised to offer 10-15% speed improvement at the same power and 25-30% power reduction at the same speed.

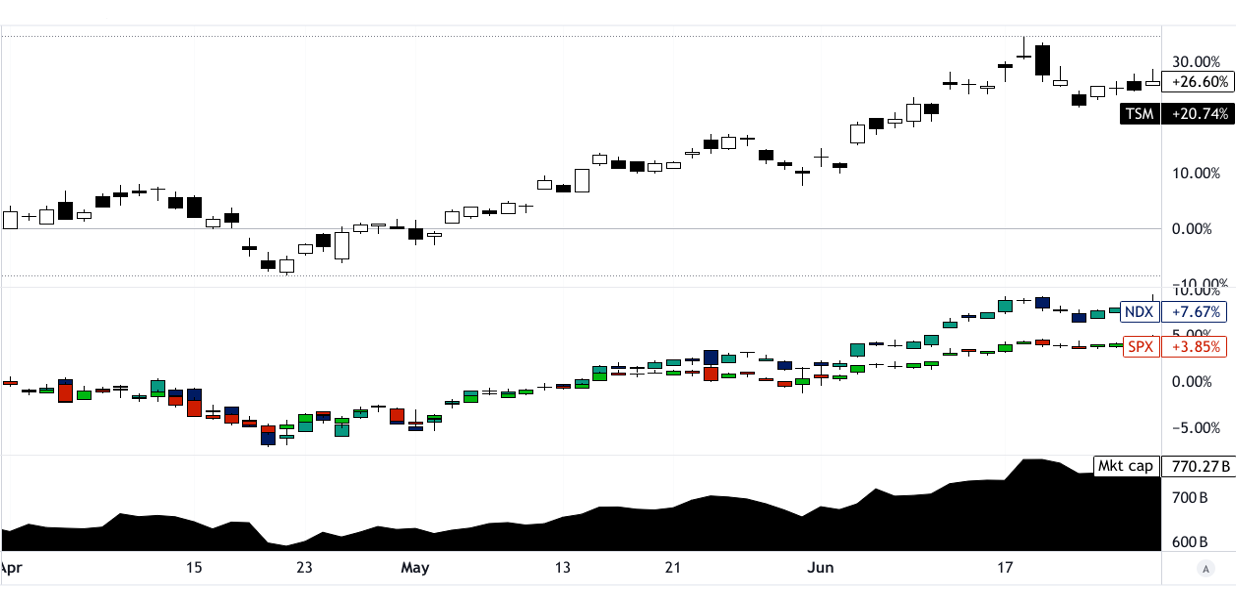

B. TSM Stock Price Performance

Taiwan Semiconductor (NYSE:TSM) demonstrated robust stock price performance over the quarter, with a significant percentage change of 26.6% (open-to-close), rising from an opening price of $137.29 to a closing price of $173.81. The stock reached a high of $184.86 and a low of $125.78, indicating substantial volatility. This performance far outpaced major stock market indices, with the S&P 500 increasing by only 3.9% and the NASDAQ by 7.8%. TSM's strong market cap of $770 billion underscores its Street dominance

Source: tradingview.com

II. TSM Stock Forecast: Outlook & Growth Opportunities

A. Segments with Growth Potential

Taiwan Semiconductor Manufacturing Company (TSMC) continues to demonstrate robust growth across several segments. The company's advanced technology processes, particularly in the 3-nanometer and 5-nanometer ranges, have seen strong demand, contributing significantly to its revenue. High-Performance Computing (HPC) now accounts for 52% of TSMC's revenue, a 28% increase quarter-over-quarter, driven by AI and data center needs. Automotive and IoT segments are also growing, with automotive increasing by 5% and IoT by 6%. These segments are poised for further expansion as demand for semiconductor components in electric vehicles and smart devices rises. The company projects Q3 2024 top-line to be between $22.4 billion and $23.2 billion. At the midpoint, This is a 9.5% sequential increase and 32% year-over-year boost.

Source: Q2 2024 Presentation

TSMC's market forecast for 2024 projects a 10% growth in the semiconductor market excluding memory, driven by AI, HPC, and 5G technologies. The company's share of the foundry industry is expected to grow to 28%, supported by its technology leadership and expanding customer base. The N2 technology is on track for production in 2025, with N2P and A16 enhancing TSMC's leadership in energy-efficient computing and high-performance applications. The A16 technology, designed for HPC products, promises additional speed and power benefits, with production slated for the second half of 2026.