- Verizon's Q2 2024 performance showed modest revenue growth, driven by increased wireless service revenue but a slight decline in EPS.

- The stock experienced a drop during Q2, underperforming the S&P 500's gain and Technicals hold a positive outlook.

- Strategic investments in 5G and fixed wireless are ongoing, but competitive and operational pressures persist.

I. Verizon Q2 2024 Performance Analysis

A. Key Segments Performance

Financial Highlights

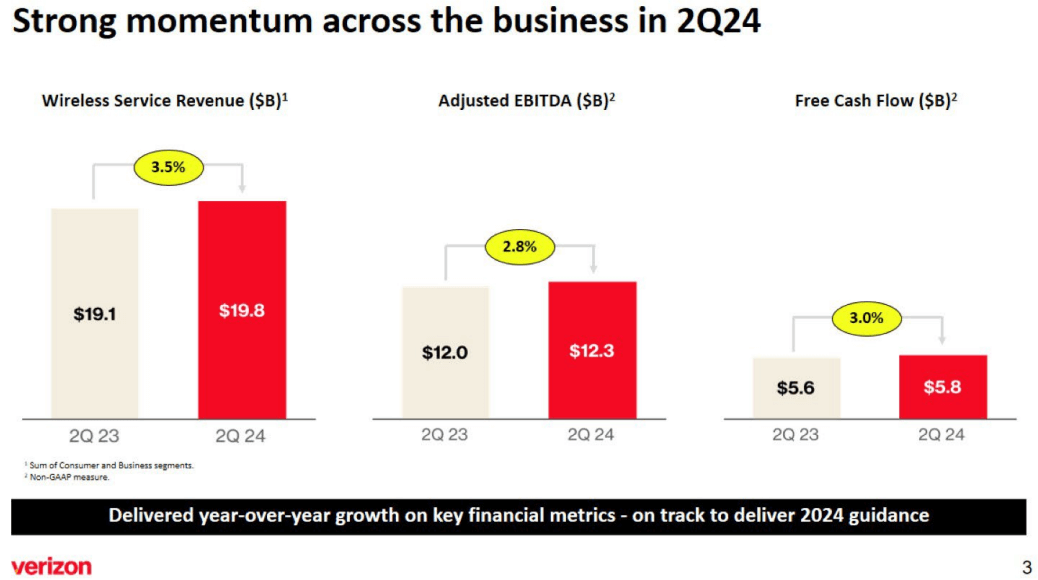

Verizon's total operating revenue for Q2 2024 was $32.8 billion, reflecting a 0.6% increase from the previous year. This growth was driven by a 3.5% year-over-year increase in wireless service revenue, which totaled $19.8 billion. This segment's growth was primarily attributed to an increase in consumer wireless service revenue, boosted by pricing actions and fixed wireless adoption. Consolidated net income stood at $4.7 billion, slightly down from $4.8 billion in Q2 2023. Adjusted EPS was $1.15, down 5% year-over-year from $1.21, primarily due to higher interest expenses and increased cash taxes. The earnings per share without special items were $1.09, a slight decrease from $1.10 in Q2 2023.

Source: 2Q24 VZ Presentation

The net unsecured debt decreased by $3.2 billion to $122.8 billion, and the net unsecured debt to adjusted EBITDA ratio improved to 2.5 times from 2.6 times in the previous quarter. Cash flow from operations for the first half of 2024 was $16.6 billion, down from $18 billion in the prior year, influenced by higher taxes and interest expenses. Capital expenditures were reduced to $8.1 billion, significantly lower than the $10.1 billion spent in the first half of 2023. This resulted in a free cash flow of $8.5 billion, an increase of 7% year-over-year.

Operational Performance

Consumer wireless postpaid phone gross additions increased by 12% year-over-year to approximately 1.8 million. Retail postpaid phone net-adds were 148,000, marking significant improvements. Prepaid services experienced a loss of 624,000 subscribers, largely due to the shutdown of the Affordable Connectivity Program (ACP), with SafeLink accounting for 410,000 losses. Excluding SafeLink, prepaid net losses were 12,000. Verizon continues to expand its broadband base, adding 391,000 net subscribers in Q2, driven mainly by fixed wireless access (FWA) with 378,000 net adds. The FWA base now exceeds 3.8 million subscribers, up nearly 69% year-over-year. Fios Internet additions were 24,000, maintaining steady growth despite the ACP shutdown.

Source: 2Q24 VZ Presentation

Technological Advancements and Innovations

Verizon launched the myHome plan for Home Internet, following the success of myPlan. These initiatives aim to enhance customer experience and expand its broadband service footprint. The company continues to advance its 5G network, with nearly 50% of its traffic now running on ultra-wideband C-Band spectrum, which supports ultra-low latency and high bandwidth applications. Verizon's AI-driven solutions have optimized customer support operations, analyzing over 800 data points per call to enhance service efficiency. The deployment of C-Band spectrum is progressing, covering nearly 60% of planned sites, enhancing network performance and customer service reliability.

B. VZ Stock Price Performance

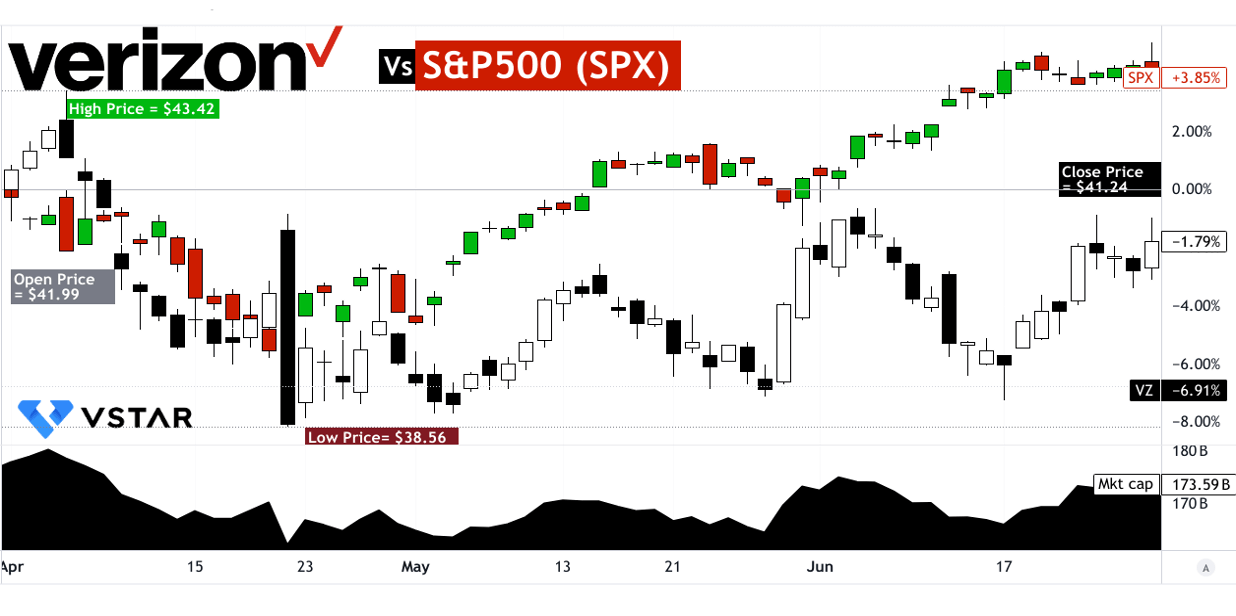

Verizon Communications (NYSE: VZ) holds a significant market capitalization of $173.59 billion. This large market cap underscores Verizon's stock which opened the quarter at $41.99 and closed at $41.24. This minor decline highlights the relative stability of Verizon stock price, although it also points to a slight bearish sentiment over the period. During the quarter, Verizon's stock experienced fluctuations with a high of $43.42 and a low of $38.56. The VZ stock price decreased by 1.79% over the quarter. When comparing Verizon's performance to the broader market, the S&P 500 index (SPX) saw a positive price return of 3.85% over the same period. This stark contrast highlights that Verizon underperformed relative to the general market.

Source: tradingview.com

II. VZ Stock Forecast: Outlook & Growth Opportunities

A. Segments with Growth Potential

Verizon Communications (NYSE: VZ) is strategically positioned to capitalize on significant growth opportunities in the communication services market, particularly within mobile data and broadband segments. As the U.S. continues its leadership in 5G technology, Verizon's investments in this area are set to drive substantial revenue growth. The company's focus on mobile data, which is expected to reach $142.4 billion in 2024, aligns with broader industry trends. The rollout of 5G technology enhances download speeds, reduces latency, and supports high-bandwidth applications, positioning Verizon to leverage AI and IoT advancements effectively. This infrastructure enables seamless AI integration and IoT deployment, catering to businesses' evolving needs for real-time data processing and connectivity.

Verizon's broadband segment is also a key growth area. With over 11.5 million broadband subscribers and a significant boost from fixed wireless access (FWA), the company is expanding its market share. The fixed wireless segment, with 3.8 million subscribers, is experiencing accelerated growth, driven by increasing demand for reliable, high-speed internet services. Verizon's strategy to enhance FWA, supported by its C-Band expansion, aims to reach 4-5 million subscribers, reinforcing its broadband leadership.

[5G share of total mobile connections in 2023 and 2030]

Source: statista.com

B. Expansions and Strategic Initiatives

Verizon's growth strategy is underpinned by robust expansions and strategic initiatives:

Research and Development Investments: Significant investments in R&D are central to Verizon's strategy. The company is advancing its 5G infrastructure and exploring next-gen technologies, such as mobile edge computing (MEC) and AI-driven solutions. These innovations aim to enhance network performance, reduce latency, and support advanced applications across various sectors.

Partnerships and Collaborations: Verizon's partnerships are pivotal in expanding its service portfolio. Collaborations with technology firms, such as its alliance with AST SpaceMobile for satellite-to-device connectivity, aim to extend Verizon's network reach to underserved areas, enhancing its 5G footprint. Additionally, partnerships with content providers like YouTube Premium and Peacock offer bundled services, enhancing customer value and retention.

Capital Expenditure and Network Expansion: Verizon's capital expenditure remains robust, with a forecasted $17.0-$17.5 billion for 2024. This investment supports the deployment of C-Band spectrum, enhancing network capacity and coverage.

These factors may benefit the company's top-line as observed in the Analysts' 2024 estimates.

Source:seekingalpha.com