I. Recent Marathon Digital Stock Performance

MARA's Move On Mining Industry

MARA Holdings, Inc. (NASDAQ: MARA), formerly Marathon Digital Holdings, Inc., is rapidly becoming a credible entity in the U.S. Bitcoin space, specifically in the digital asset technology sector. The company has made prominent progress in prioritizing sustainability and energy efficiency, making it an attractive choice for day traders.

The company focuses on transforming stranded and unused energy into economic values, bolstering mining capabilities, demand surges, and allocating the increasing demand for eco-friendly practices in the crypto space. It utilizes its operational efficiency by locating its significant data centers close to affordable energy sources. The additional cooling systems enable its transformation capabilities of waste energy to productive resources, benefiting both environmental demand and financial performance.

In Q2, MARA Holdings' revenue growth surged by 78%, reaching $145 million compared to Q2 last year, indicating robust mining activity and declaring a significant company position in the Bitcoin mining industry.

Is The HODLing Approach Good For MARA Investors?

Mara Holdings recently updated its treasury policy to embrace its full HODL policy, which means it will retain all BTCs it produces. The decision reflects the firm's strong belief in the long-term value potential of BTC as a premier treasury reserve investment element.

The company is rapidly expanding its mining operations to achieve a hash rate of 50 EH/s by 2024. As part of development at the Granbury, Texas site, the company recently activated 18 immersion containers and initiated the transformation of part of the data center to an enhanced immersion cooling system, compared to traditional ones. This transition is anticipated to finish this year, positively boosting MARA's mining capacity and efficiency.

Expert Insights on MARA Stock Forecast for 2024, 2025, 2030 and Beyond

In Q4 2021, the MARA stock price hit a high near 83.45; since then, it has remained in a downtrend, making a low near 5.32 and bouncing back toward a high near 34.09. The price is floating at a potential support level and is ready to reach its peak. Before proceeding further, let's check at a glance what experts anticipate seeing MARA stock price in 2024, 2025, 2030 and beyond.

|

Providers |

2024 |

2025 |

2030 & beyond |

|

StockScan |

$21.26 |

$33.32 |

$48.57 |

|

WalletInvestors |

$19.32 |

$18.09 |

$11.08 |

|

Coincodex |

$17.00 |

$38.63 |

$4,016.85 |

|

Coinpriceforecast |

$16.29 |

$18.32 |

$47.00 |

II. MARA Stock Forecast 2024

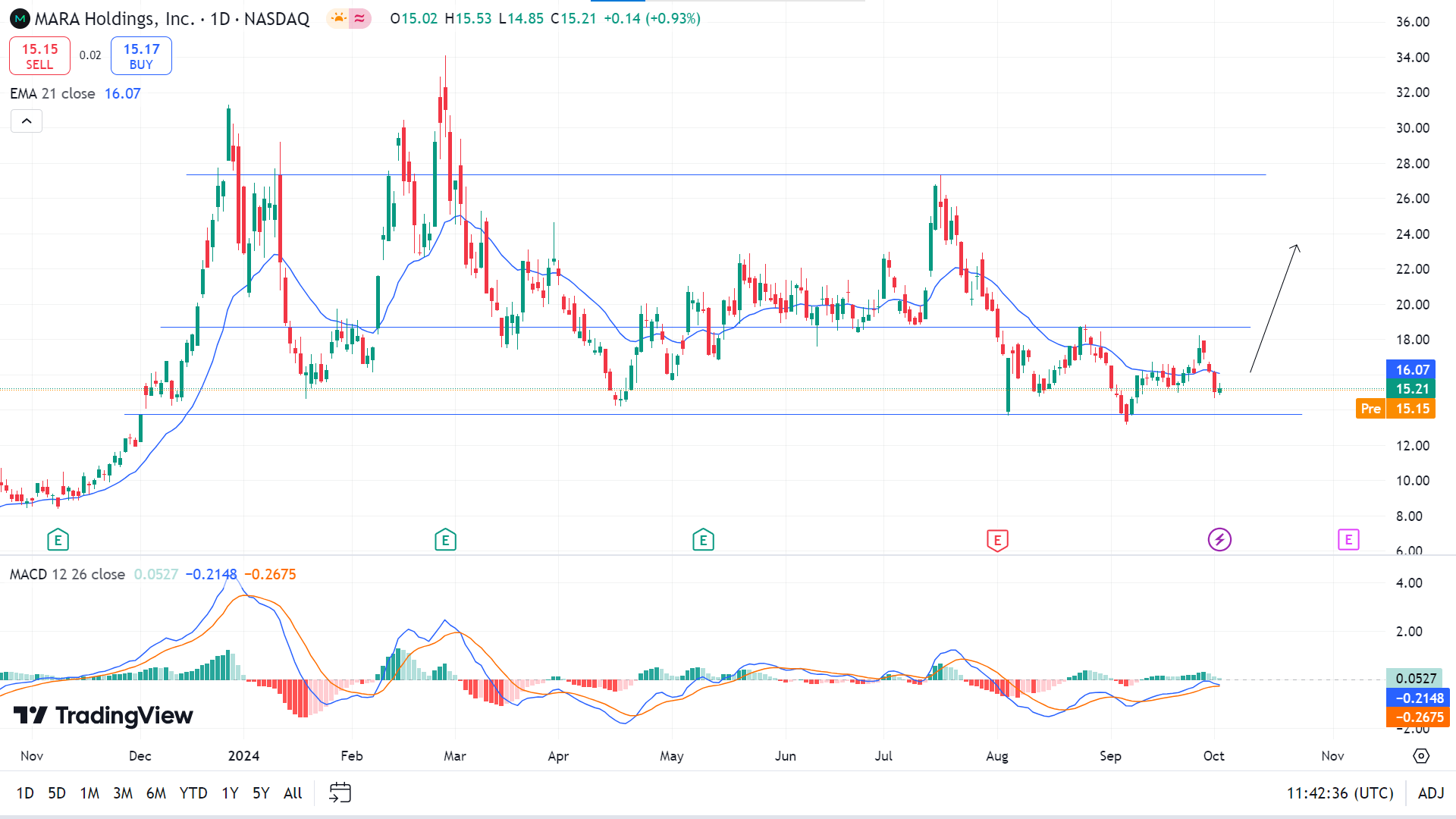

In the recent chart, the price is bouncing within a range of 13.74-18.70, whereas a breakout above the range may trigger MARA stock price to drive the resistance of 27.34 by the end of 2024.

MARA has been trading within a tight range for a considerable time, where a valid range breakout momentum could offer a trend trading opportunity. Moreover, the broader market remains within the bullish wave seen in 2023, suggesting an ongoing bullish momentum. Therefore, the primary outlook for this stock would be to find the following strategy.

The price is moving below the EMA 21 line on the daily chart, while the EMA remains flat. It is a sign of an extreme sideways market, where the major market trend remains bullish. As the MACD Histogram maintains a positive presence for a considerable time, we may expect bulls to win in this stock.

Based on the MARA Stock Forecast 2024, a valid bullish range breakout with an hourly candle above the 19.20 level could open a long opportunity aiming for the 28.00 level.

On the other hand, if the price continues to float below the EMA 21 line and the red histogram bars appear below the midline of the MACD indicator window, it may drop to the primary support of 13.74, followed by the next possible support near 10.50.