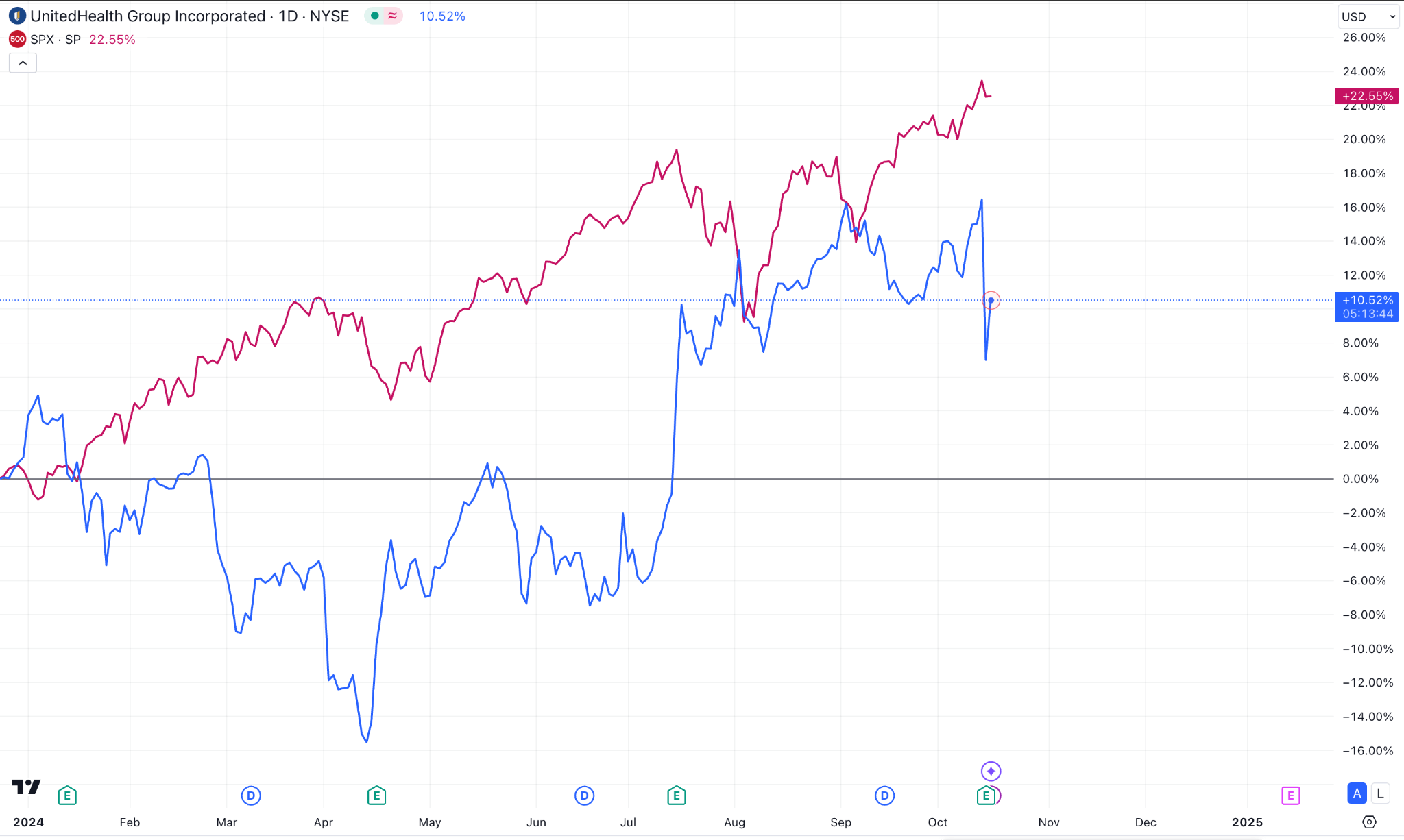

I. Recent UnitedHealth Stock Performance

Robust Performance of UNH

UnitedHealth Group Inc. (NYSE: UNH) has achieved a significant milestone, with its stock reaching a record high of $607.98, reflecting a 12.67% increase over the past year. This notable ascent is driven by increasing demand for healthcare services, consistent positive performance, well-timed acquisitions, and UnitedHealth's agility in an ever-changing market, reinforcing its position as a dominant force in the healthcare sector.

TD Cowen maintains a Buy rating on the UNH stock, projecting a 12.6% year-over-year growth in the forthcoming earnings report. The report is anticipated to address the impact of disruptions related to Change Healthcare (NASDAQ: CHNG), providing further clarity on the company's performance outlook. KeyBanc has also issued an Overweight rating, underscoring UnitedHealth's resilience and ability to navigate strategic challenges effectively.

UNH Management Forecast

Due to more significant delays than expected from a cybersecurity issue earlier this year, UnitedHealth Group (UNH) updated its full-year earnings outlook. The company's shares dropped 8.1%, the biggest decrease on the Dow and among the worst on the S&P 500.

In a conference call with investors, CEO Andrew Witty stated that the business is adopting a "more conservative than usual" estimate for the upcoming year, in part because of low state reimbursement rates for Medicaid plans that serve low-income customers and government payment reductions for Medicare plans. In December, UnitedHealth intends to release a more thorough prediction.

As many seniors planned treatments they had put off during the COVID-19 outbreak, the demand for healthcare services under Medicare, which covers individuals 65 and older or those with disabilities, has increased dramatically since late last year. A change in Medicaid membership has also resulted in greater medical costs for the corporation and other insurers, leaving them with a larger proportion of sicker patients.

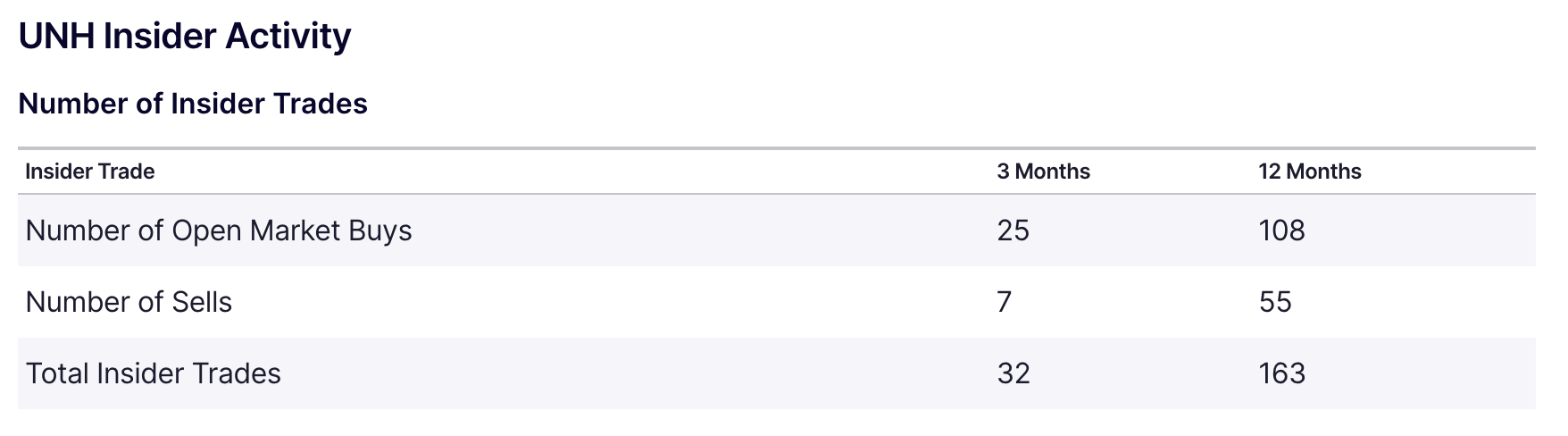

UnitedHealth Insider Transactions

On July 18th, UnitedHealth Group's Executive Vice President, Erin McSweeney, sold 1,500 shares at an average price of $579.03, totaling $868,545.00. After the sale, she holds 7,785 shares, valued at roughly $4.51 million, with no significant change to her overall ownership. Additionally, on July 17th, Chief Accounting Officer Thomas E. Roos sold 2,851 shares at an average price of $569.88, generating $1,624,727.88. Roos now holds 29,501 shares, with a total estimated value of $16.81 million. Like McSweeney's transaction, this sale did not result in any material reduction in his ownership of UnitedHealth Group stock. Both sales were recorded following SEC regulations.

Expert Insights on UNH Stock Forecast for 2024, 2025, 2030 and Beyond

UNH stock price, floating near the ATH, recovered from the loss of Q1 this year and remained on a straight uptrend since then. The chart reveals an attractive performance for the asset from previous years till now through posting consecutive gaining years. However, before proceeding further, let's check experts' price predictions for UNH stock prices for 2024, 2025, 2030, and beyond with a quick view.

|

Providers |

2024 |

2025 |

2030 & beyond |

|

StockScan |

$550.39 |

$619.49 |

$800.18 |

|

WalletInvestors |

$622.45 |

$662.35 |

$796.76 |

|

Coincodex |

$640.32 |

$731.23 |

$1,858.10 |

|

Coinpriceforecast |

$637 |

$768 |

$1,194 |

II. UNH Stock Forecast 2024

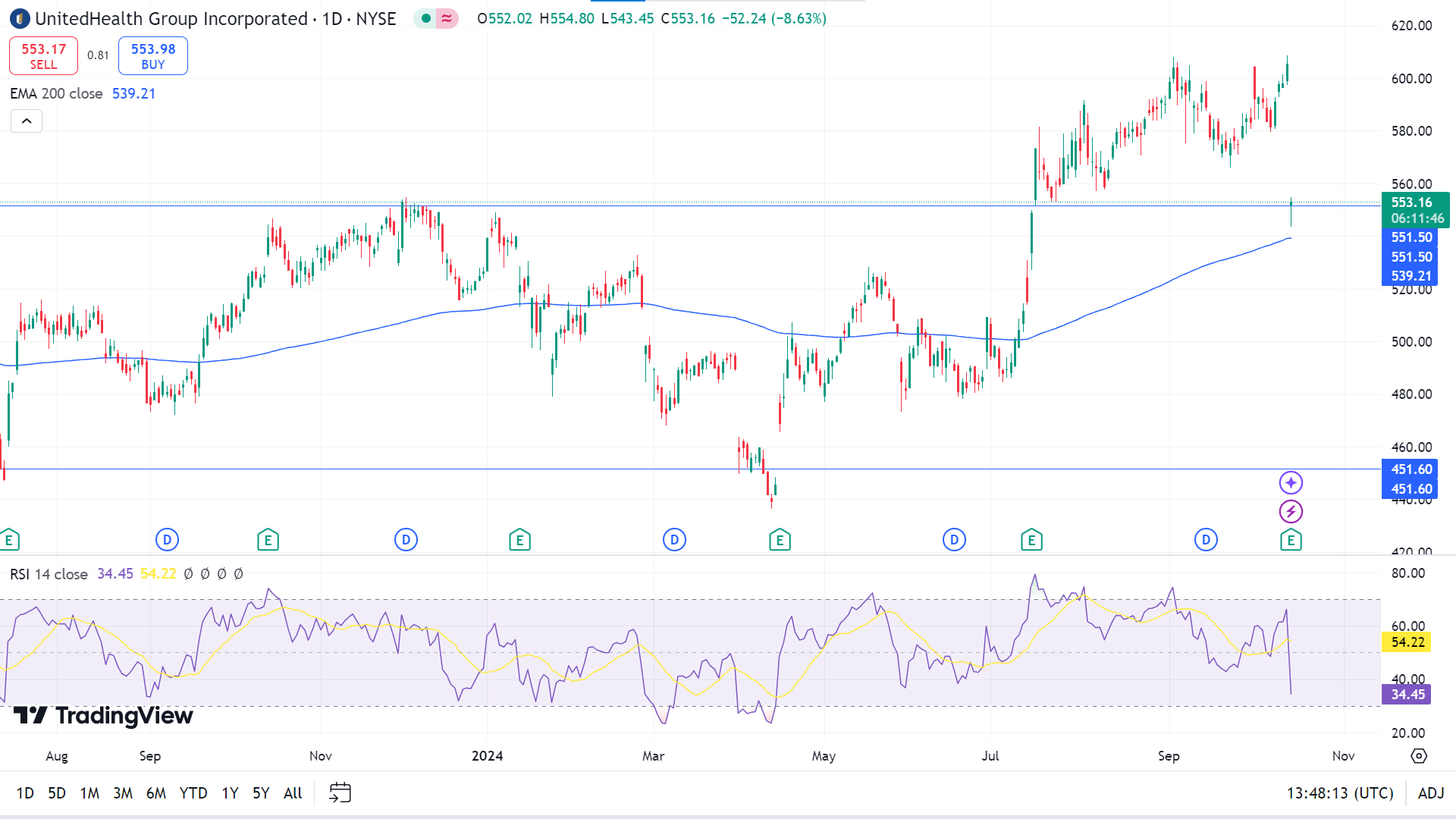

The UNH stock price posted an impressive gain in recent months after retracing in Q1; since then, it has been moving on a solid uptrend and may end the year 2024 by reaching a new ATH near the 650.00 level.

The daily chart confirms that the price of UNH stock successfully broke the range of 451.00 -551.00 and was retraced to validate the breakout. This enables investors to find investment opportunities, as the long-term trend has been bullish for decades. However, the primary outlook for the UNH stock could be bearish as a corrective pressure.

The price suddenly drops at the EMA 200 level to validate the range breakout that it has remained in since November 2021. The EMA 200 line still suggests bullish pressure is intact on the asset, which may drive the price toward the primary resistance near 605.54. A breakout of that resistance might trigger the price to hit a new possible resistance near 605.00 level.

Based on the UNH Stock Forecast 2024, the corrective price action at the all-time high area, with a divergence with the RSI could signal a downside correction towards the 200 day EMA line. Moreover, the price may decline toward the nearest support near 501.24 or further downside toward the previous range low of 451.60.